Much has already been said about the Trading Solutions Provider, Umarkets. The online trading community is a polarizing venue in that it had varying opinions about the company. Some say that the company is nothing but a fraudulent entity out to steal money from its clients. Some say that it is actually a reliable trading solutions provider able to provide good trading conditions through comprehensive tools.

Albeit normal for providers such as Umarkets, it does instil confusion for those wanting to enlist the services of a third party in trading. Many are those who are easily swayed by popular opinion may these prove beneficial or not. As this is the case, a more pointed assessment of the company’s services is in order.

This review is a result of months spent with Umarkets. Throughout the duration, the review team had performed an exhaustive examination on the following facets of its service:

- The assets that the firm gives its clients access to

- The trading accounts that are available

- The trading platforms that the firm provides

- The fee structures and commissions that come with transactions performed through the firm

In addition, the review team had also looked into the company’s regulatory status and industry tenure to see if they are operating under sound regulating bodies.

About Umarkets

Umarkets has been operating under the legal entity, Market Solutions Ltd. since 2017 in the Saint Vincent and the Grenadines. The company was established back in 2008 with the initial trading name of Maxi Services Ltd. which was registered out of Belize. As already stated earlier, the company is a trading solutions provider, not a brokerage. The company specializes in allowing access to CFDs.

While the ownership of Umarkets had changed a couple of times, the service provider had maintained good ties with HSBC, Europe’s biggest bank. As of writing, the company had served over 1,200,000 clients from 87 countries across the globe.

Umarkets’ trading activities are sanctioned by the Belize International Financial Services Commission (IFSC), making it a regulated and legitimate solutions provider.

Offers and Services

Accessible Trading Instruments

Through Umarkets, traders are given access to various assets. The offerings are deemed by the review team to be impressive in range and conducive for all types of traders.

Umarkets allow for the trade of 70 currency pairs and 16 cryptocurrency pairs.

However, commodities are limited to only 9 CFDs. On the other hand, Cross-asset diversification is allowed with 141 Equity and 17 Index CFDs.

The total of 253 assets permits retail traders build and manage a diversified portfolio with lucrative trading opportunities across five (5) sectors.

Available Trading Accounts

What had jumped out initially for the review team are the costs for opening trading accounts with Umarkets. It could not be stressed enough that the company is not a brokerage, meaning that there is a general understanding that whatever amount a trader puts in just goes to two (2) avenues: 1. the actual trades that the client chooses to make and 2. the third party itself, Umarkets. As these stand, people tend to be turned off initially when faced with the account options that the company lays out.

So let us take a look at the specifics of each account offering to understand why the review team had come to their findings.

The Mini Account

This type of account requires a minimum deposit of $500, admittedly higher than what other service providers and brokerages ask for. While this is the case, it is to the opinion of the review team that asking for higher deposits as opposed to minimum ones would most likely create better trading conditions for the traders. Why is that? It’s because it is highly likely that when traders engage in transactions with only a few dollars in their accounts, these will easily be wiped out without the benefit of covering possible losses. The only disadvantage that the review team sees in choosing to open the Mini account is that it does give access to all the pertinent features.

The Standard Account

Traders are required to deposit $5,000 to open a Standard Account. For this amount, all features are already available.

The Gold Account

A minimum account of $10,000 is needed to open a Gold Account. What is seen as glaring here is the fact that there are no evident standout advantages with this account from the Standard Account.

The Platinum Accounts

The Platinum Account is the most expensive among the accounts that traders may be able to open with Umarkets. However, much like the Gold Account, there are no significant departures from the Standard Account that users can benefit from.

Islamic Account

This type of account, (also referred to as “Swap Free Account”) is made available to clients upon request. Given the prohibitions of the Islamic faith with trading, the Islamic Account follows the stringent regulations of the Sharia Law.

Offered Trading Platforms

Umarkets offers two trading platforms that its clients can do trades through:

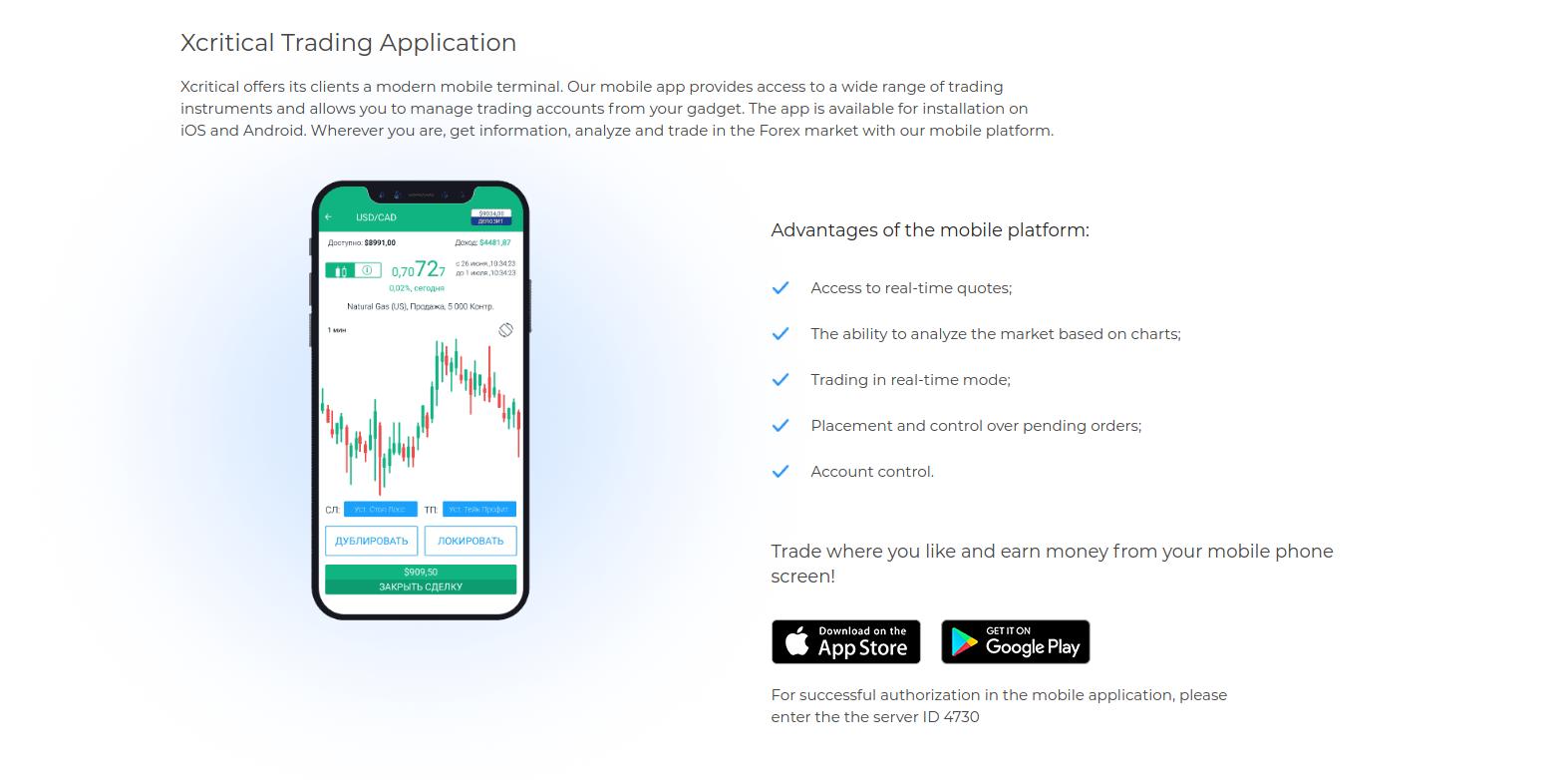

The xCritical Trading Platform

The xCritical Trading Platform is lauded by the online trading community as a software that can compete with industry-favorite, MetaTrader 4.

The xCritical trading platform comes with the AutoChartist tool, the only thing that is a bit of a letdown to the review team is that the only way by which one can avail of this if he or she deposits a total of $5,000. Apart from this, all of the features that the platform offers can rival that of MT4, from charting options to accessible trading instruments.

MetaTrader 4 (MT4)

Umarkets is wise in partnering with MetaQuotes to offer MetaTrader 4 to its clients.

MT4 is speedy in executing transactions and makes a wide range of tools such as customizable charts and trading signals available to traders. One thing that the review team noticed about the platform (through Umarkets’ offering at least) is that the AutoChartist function is not enhanced, something that can be understood given that it is being marketed through the xCritical platform.

Regardless, the MT4 platform functions well through an intuitive user interface.

Fee Structure and Commissions

Through Umarkets, trading Forex and Metals CFDs come with no commissions. Energies, Cryptos, Equity, and Index CFDs, on the other hand, are charged.

Fee structures peg the EUR/USD spread at 2.5 pips within the Mini account. In the Platinum Account, it is brought down to 1.0 pips.

Save for Cryptocurrencies, Commissions across all asset classifications range from $3 to $7 per side. With respect to exceptions, these are at $10 and $20.

As with other trading solutions provider, the Swap Rates on leveraged overnight positions apply on Islamic trades. As the negative charges are the ones only disclosed, it is still not made clear how the positive ones are transacted. The costs that are made clear are at 0.005% to 0.015% of the transaction size.

Umarkets charges upon inactivity of 90 days and a monthly fee of 5% is applied for maintenance.

A 5% fee is also asked should a withdrawal be requested prior to traders being able to execute 5 trades. What got our attention with these fee structures is Umarkets’ transparency with them. The company’s clients are given due notice with every charge it’s going to make.

Additionally, traders who make use of the MT4 platform would be able to access Swap Rates through the following process:

- Right-click on the the desired symbol in the Market Watch window. Afterward, click on “Symbols”.

- Choose the currency you desire and then click on “Properties” which can be found on the right side.

- Look for Swap Long and Swap Short by scrolling down.

Trade with Umarkets Today!

While it is true that the costs for the opening of each trading account within Umarkets may turn off some, it is not without reason. The service provider makes sure that possible initial losses are covered through what could remain from preliminary trades. However, this does not diminish the fact that the firm asks for high deposits on its Gold and Platinum Accounts which bear no evident departures from the Standard Account. This is something that Umarkets need to look into restructuring.

Apart from these, the offerings made by Umarkets make them appear decent and reliable. The range of trading instruments is noteworthy and the fees and commissions are reasonable.

As for the negative reviews it had received from the online community, it is highly likely, (as the review team observed) that these result from not completely understanding the rules that guide transactions lodged through the company. As this is the case, it is advised that the online testimonies regarding the firm be taken with a grain of salt.

In general, the review team could confidently say that it wouldn’t hurt to try out Umarkets. Interested parties just need to prepare themselves for the costs they have to pay to open an account.