If we are to compare indices with individual stocks, it is inarguable that the former have lower risks as they carry a diverse portfolio and have smoother price movements. More so, trading indices is also a helpful indicator for both macro and microcosmic scale economies. Enumerated below are some of the most well-known strategies for index trading.

Day Trading

As the name suggests, traders who engage using this structure only hold positions within the day. The objective of day trading is to open positions just to close all of them before the market closes. This comes convenient for people who do not have additional capital for fees and charges that overnight trading requires. It is important to note that this is a fast-paced trading, and only modest profits arise from small price movements. As this is the case, day trading fits those who have enough time reading charts and analyzing the markets.

Looking at the downside of it, this practice is taxing and time-consuming. It also involves rapid decision-making, prompting traders to decide hastily once prices swing towards a specific direction. To negate this dilemma, day traders are suggested to be vigilant about economic and political news. Prices are sensitive to political and economic events, and this will give traders additional insight what position to take.

Breakout Strategy

This type of index trading focuses mainly on a trend’s initial stages. Heavily used by active index investors, this is ideal for those who look at major price movements. By analyzing a trend’s early descent or ascent, positions are backed with larger volatility. While indices are still susceptible to such, proper management and utilization of this strategy will reduce risks.

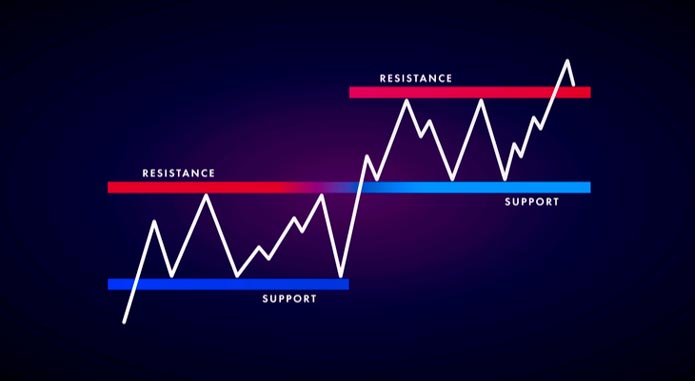

To determine a breakout, traders need to find a price breaching either the support or resistance level with increased volume. Simply put that these levels are co-dependent for analyses, whereas the support level is where a price tends to bounce back after falling. As for the resistance, it is where a price tends to plunge after ascending.

Note that it is ideal to place long position should a price breach above resistance. On the other hand, it is recommended that traders go for short position once a price breaks below support. After any of these lines was breached, the index will be more volatile, and prices commonly swing where the breakout happened.

Technical Trading

Technical trading is heavily reliant on the use of charting, patterns, and indicators. These images manifest through multiple candlesticks, and these may be of great advantage in determining the next price movement. Below are some of the popular indicators that may be used in technical trading.

Trend Indicators

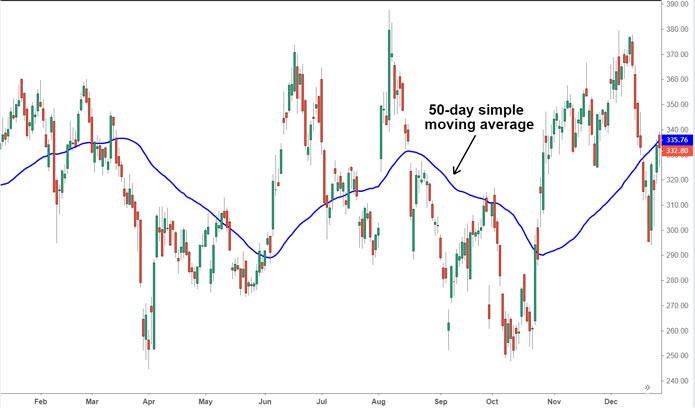

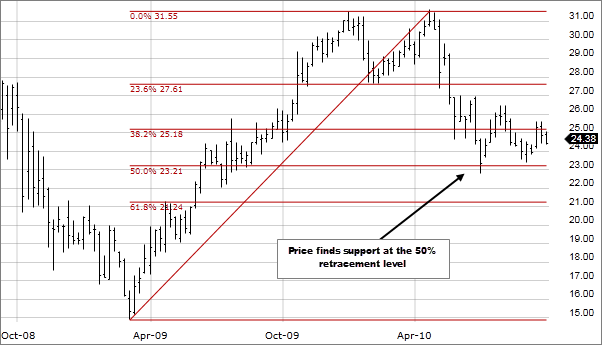

These are clear and direct indicators that are very much helpful in determining whether markets will run bullish or bearish. Moreover, they are usually called as oscillators since they tend to swing massively. Some of the trend indicators are: Parabolic SAR, Simple Moving Average, Exponential Moving Average, and Fibonacci Retracement.

Momentum Indicators

These types of indicators determine the strength of a trend, giving traders a clear idea if a short-term reversal will occur. Once a dwindling momentum manifested, it only indicates that the market is growing weak therefore subject to retracement or reversal. But once the momentum was seen upbeat, the trend bears the same strength and will likely last. Traders may use any of the three momentum indicators: 100 Line Cross, the Momentum Crossover, the Divergence signal.

Volatility Indicators

For those who want to see how much a price changes over time, volatility indicators may be utilized. Since volatility played a key role in profit-making, traders need to analyze such. Increased level of volatility denotes a rapid increase in price. But while this gives traders more opportunity to place positions, it is not indicative of price movements, only price ranges.

Position Trading

For those who intend to keep their positions for long term, position trading best suits the practice. This is tentative, and timeframes purely depend on traders. Trades may be kept for several days, weeks, or longer. One advantage that this carries is the dismissal of short-term market crashes. While this may rake in fewer returns compared with day trading, the trades carry larger profitability.

Conclusion

One might ask which among the aforementioned the best strategy for index trading is. There is no definite answer since all are guaranteed to rake in profits. However, one must understand his or her trading structure so as to implement which one is the best strategy. This, together with proper risk management, is just one of the keys to enhance margin of profitability.